Why We Can’t Afford to Lose LIHEAP as Households Face Record Energy Costs

The Low Income Home Energy Assistance Program (LIHEAP) faces an uncertain future. In 2025, the White House proposed a complete elimination of LIHEAP in its FY 2026 budget request. While Congress has not adopted that proposal, funding decisions for FY 2026 remain unresolved. In a separate but related development, the entire LIHEAP staff at the Department of Health and Human Services (HHS) was laid off in April 2025—a move that has raised serious concerns about the federal government’s ability to administer the program. With record-breaking heat sweeping the country and energy costs projected to reach a 12-year high, the loss or disruption of LIHEAP would put millions of low- and moderate-income households at risk.

In a recent blog post, we explored how clean energy technologies—like energy-efficient appliances and solar panels—can provide long-term relief from high utility bills. But for households already struggling to pay for energy, these solutions remain out of reach. Nearly 70% of SaverLife members reported difficulty in affording energy costs in 2025. And 40% were behind on utility bills in 2024. What they need is immediate, targeted support.

That’s where LIHEAP comes in. The vital program supports low-income households to help cover the cost of heating and cooling, an increasingly necessary resource as climate-driven weather extremes become more frequent and dangerous. LIHEAP is a critical safety net for millions of households, and we cannot afford to let the program disappear. In this piece, we explore who LIHEAP is reaching, who’s being left behind, and what states and partners can do to help households stay safe in the face of rising energy costs and extreme weather.

The Vast Majority of Members Struggle to Afford Heating and Cooling Costs

Our recent research into the financial impacts of climate change focused on energy burden and the use of energy assistance programs. The findings make it clear that many SaverLife members are already on the financial edge, and rising energy costs are pushing them even further. For instance, nearly 80% of members reported that it was “very” or “somewhat” difficult to pay their utility bills last summer, and 72% said the same about last winter, highlighting that both high cooling and heating costs strain household budgets throughout the year.

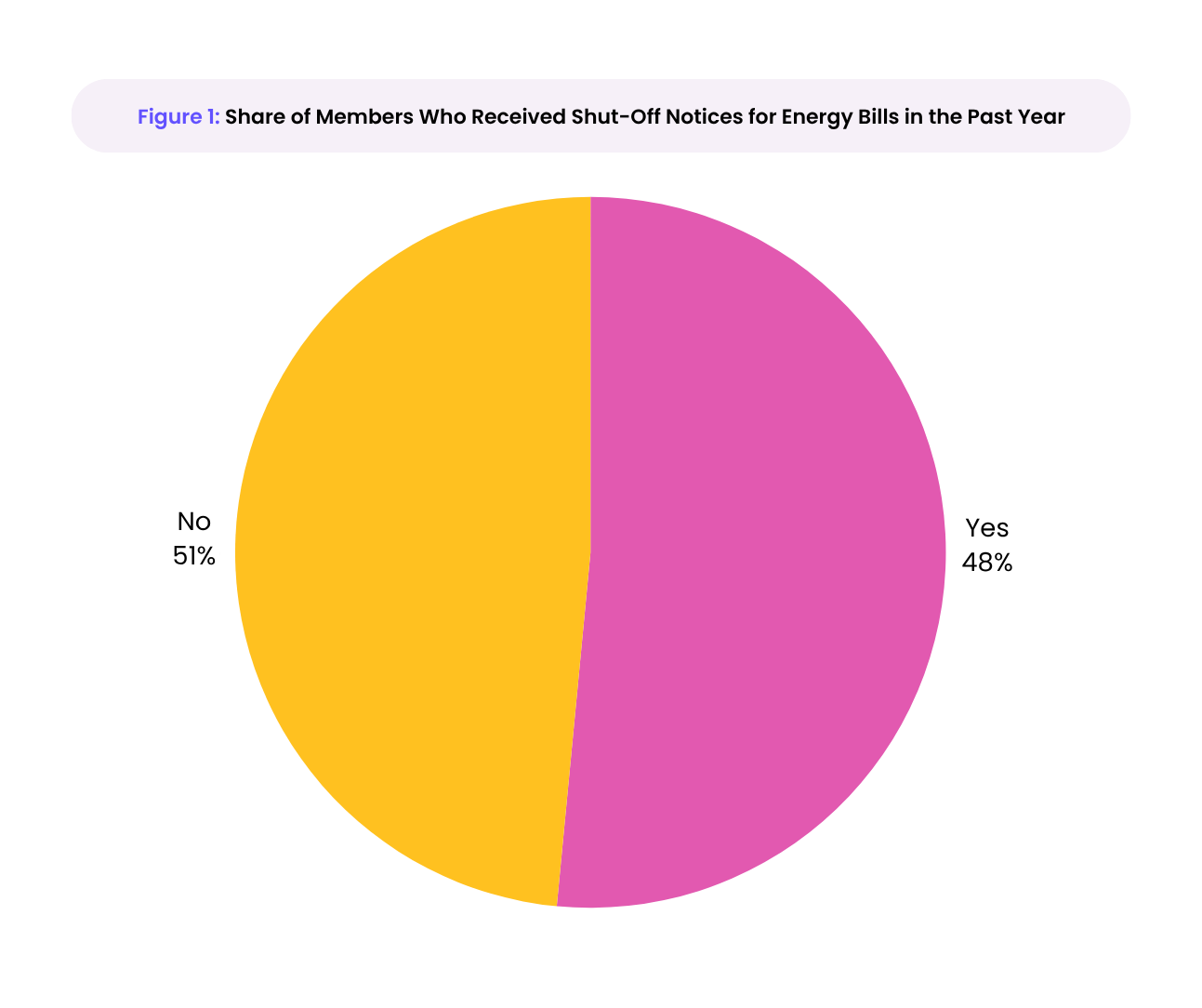

What’s especially concerning is the financial fragility beneath these burdens. Many members report sacrificing basic needs and taking on more debt to afford their home energy costs: 57% said they cut back on food, and nearly 40% reported increasing debt in the past six months due to unaffordable energy bills. This level of financial precarity turns energy costs into a compounding hardship for already unstable households. Managing these bills becomes a constant balancing act, where one unexpected spike can tip a household into crisis. In fact, nearly half of SaverLife members report receiving a utility shutoff notice in the past year (Figure 1).

Source: 2024 SaverLife Energy Cost Burden Survey.

The data clearly shows that the majority of SaverLife members need support with their energy costs. The stakes are high, as many households are already struggling to stay afloat. LIHEAP can prevent households from experiencing both deeper energy insecurity and financial insecurity.

Limited Funding Has Long Undermined LIHEAP

Even before LIHEAP faced threats of elimination, the program had long been constrained by chronic underfunding, preventing it from meeting the scale of the need. Funding levels limit the number of households able to receive assistance, even when they likely meet eligibility requirements. In some cases, available funds are depleted before applications can be approved.

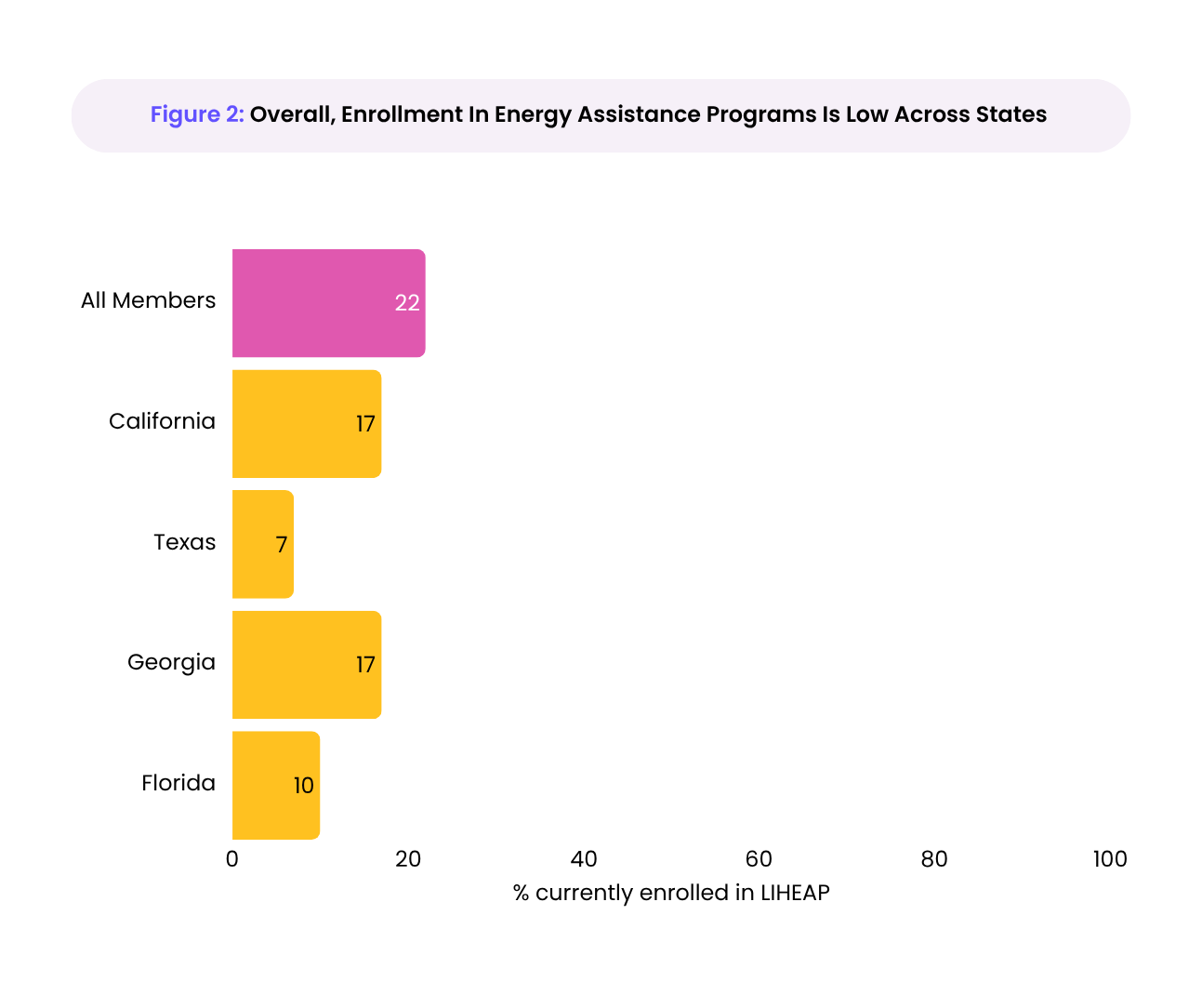

Our earlier blog examined how high utility costs weigh on households in four key states: California, Texas, Georgia, and Florida. Despite widespread financial strain, enrollment in LIHEAP remained low across all four. Even in California, where outreach strategies are stronger, fewer than one in five members were enrolled in the program (Figure 2).

Source: SaverLife Climate Tracker survey, April 2025. Some differences are significant at the 95% confidence level: Californians report higher enrollment than members living in Texas.

While milder temperatures may partly explain lower LIHEAP usage in states like California, they don’t account for the low participation seen nationally. All four states in our analysis offer year-round assistance, but states face major constraints in delivering that support effectively. States are being asked to administer LIHEAP with limited federal funding and funding delays, all of which make it difficult to plan and scale programs to meet the need. The result is not a lack of demand, but a system hampered by uncertainty and resource scarcity, leaving many eligible households without the support they need.

Even Eligible Households Struggle to Access Support

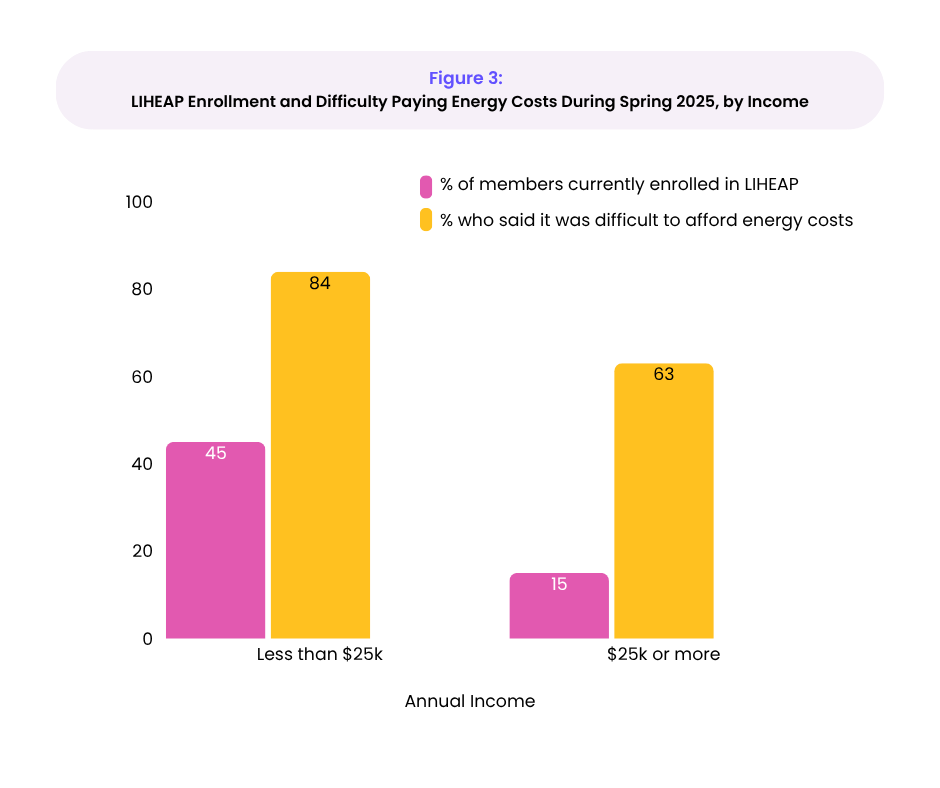

To better understand who is able to access energy assistance, we also looked at LIHEAP enrollment by household income, a key factor in determining eligibility. While state-level thresholds vary, households earning under $25,000 annually are typically eligible.

Yet even among these lowest-income households, energy hardship remains widespread and support isn’t guaranteed. Just 45% of members earning less than $25,000 reported receiving LIHEAP in the past year, even though 84% said it was difficult to afford their energy bills. The pattern was not isolated to very low-income households: among members earning $25,000 or more, 63% also reported difficulty affording energy costs, yet only 15% had enrolled in LIHEAP.

Figure 3 illustrates this disconnect: even among the lowest-income households, energy hardship was widespread and access to relief was far from guaranteed.

Source: SaverLife Climate Tracker survey, April 2025. Some results are significant at the 95% confidence level: those earning $25,000 or less annually more frequently report difficulty in paying energy costs than those earning $25,000 or more annually. .

Figure 3 also shows that 63% of SaverLife members earning $25,000 or more reported that it was difficult for them to afford energy costs. Furthermore, in analyses not shown, over a third (39%) of members earning $100,000 or more reported struggling to afford energy costs. This suggests that there are many more families who could potentially benefit from LIHEAP.

These findings challenge the narrative that LIHEAP is underutilized. The real issue is that the need far outpaces what our current systems and funding levels are built to deliver. And now, with the program under threat, the gap between who needs help and who receives it is likely to widen even further.

LIHEAP Outreach Reaches the Right Households, But Resources Fall Short

While lower-income households—those most likely to qualify—are somewhat more aware of LIHEAP than higher-income groups, a troubling share still don’t know the program exists. This could be in part because many states are cautious about ramping up outreach when they know they may not have the resources to meet the resulting demand. Therefore, in order to expand access, states need more funding and predictability so they can promote the program without the risk of turning eligible families away.

Nearly one in three members earning under $25,000 said they had never heard of LIHEAP (Figure 4). In states like Texas and Georgia, that figure was even higher, despite the fact that all four states in our analysis run year-round programs.

Source: SaverLife Climate Tracker survey, April 2025. Differences across income groups are statistically significant at the 95% confidence level.

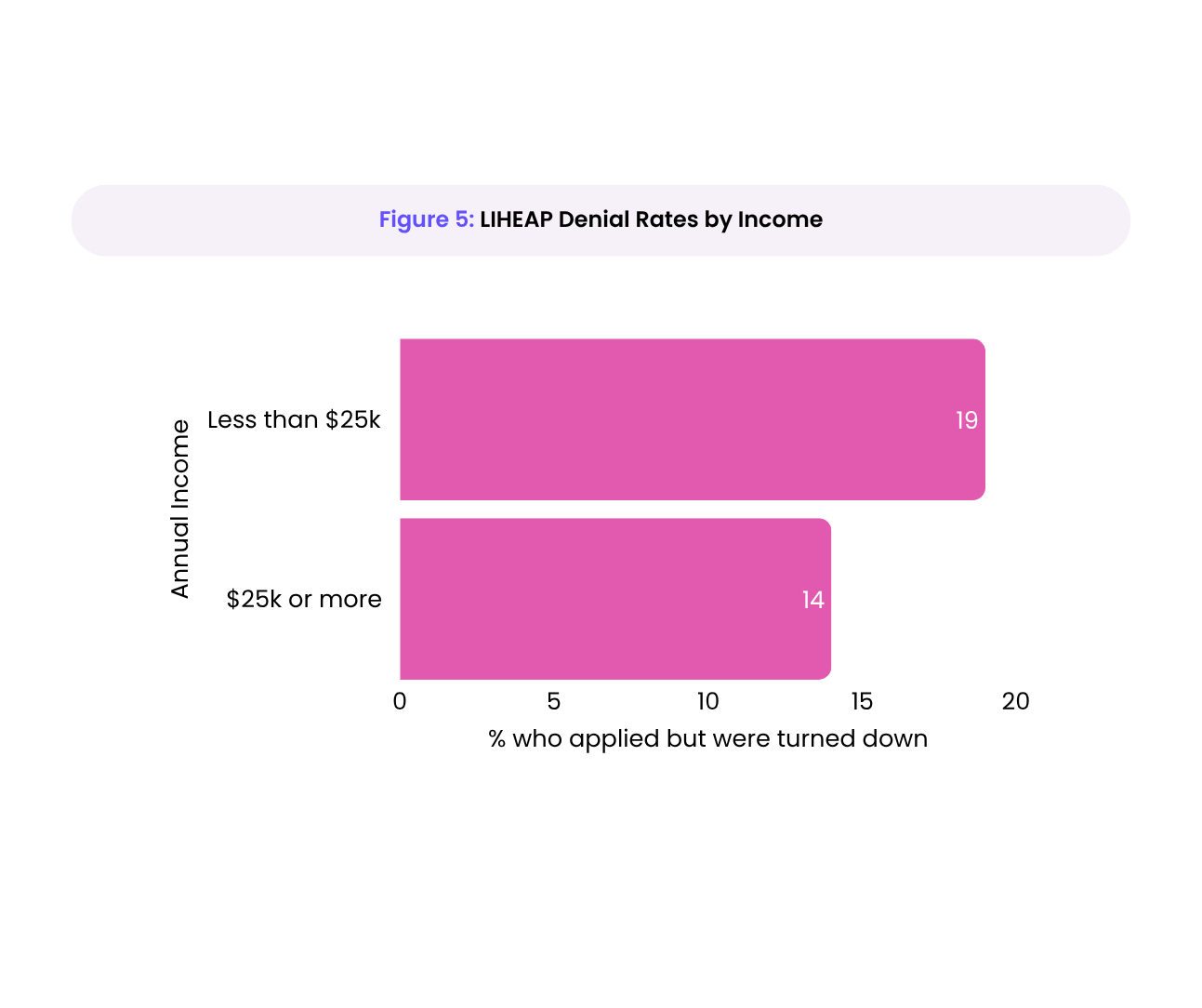

SaverLife’s data suggest that members, in fact, are being turned away despite meeting income qualifications. Among SaverLife members earning under $25,000, nearly 1 in 5 who applied for LIHEAP reported being denied (Figure 5). These are households most likely to qualify and most likely to be in urgent need. Denials often stem from limited funding that runs out too quickly, complex application processes, and documentation requirements that are difficult to meet under financial stress. For households already in crisis, any one of these hurdles can shut the door on support.

Source: SaverLife Climate Tracker survey, April 2025. Differences across income groups are not statistically significant at the 95% confidence level.

Who Will Step Up If LIHEAP Disappears?

LIHEAP was originally created to help low-income households manage home energy bills, especially during the most extreme hot and cold weather. Over time, as household budgets have become increasingly strained and energy prices have risen, the program has become one of the few forms of direct financial relief available to families trying to stay current on their utility bills.

The program was built to help families ensure their comfort and safety, especially during heat waves and cold snaps. For many families, it has been a lifeline. Now, with the program at risk of losing funding, millions of households could lose a critical layer of protection. There is no other federal safety net focused solely on heating and cooling assistance.

LIHEAP has long been underfunded, limiting its ability to meet the scale of need. Now, with proposed federal cuts on the table and key staffing disruptions already underway, the program faces even greater uncertainty. That’s a dangerous step backward. Our findings underscore the ongoing and urgent need for energy assistance and the consequences when households can’t access it.. As LIHEAP’s future hangs in the balance, states, utilities, and partners must act to ensure families aren’t left behind. Here’s what they can do to meet the moment:

Strengthen State and Local Investments in Energy Assistance. With limited federal LIHEAP funding, states will need to build out or expand their own efforts to meet growing demand. This includes allocating general funds for utility relief, creating emergency grant programs for arrears and shut-off prevention, and coordinating with utilities to deliver targeted aid. Some states already operate supplemental initiatives alongside LIHEAP, which can serve as models for how to scale support quickly and effectively. To move from stopgap measures to long-term resilience, states should also begin laying the groundwork for systemic reforms like ensuring continuity of service and sustainable access for those at greatest risk.

Expand Partnerships with Utilities, Philanthropy, and Local Governments. State-led efforts can't succeed in isolation. Utilities have a vital role to play in identifying high-need households, offering arrears management and flexible repayment plans, and integrating outreach into monthly communications. Philanthropic partners can bolster these efforts by funding emergency assistance pools, supporting outreach infrastructure, and investing in community-based navigators to help households access available help and navigate the application process. Local governments can contribute by leveraging their data systems, embedding outreach into existing services, funding navigation infrastructure, and coordinating resources across programs and partners.

Broaden the Focus Beyond Bill Payment. Energy insecurity doesn’t end with a missed payment. It often triggers a cycle of financial instability. When households fall behind, they face ballooning debt driven by late fees, disconnection charges, and large deposits just to restore service. These added costs can trap families in prolonged financial instability. States should implement stronger credit and utility protections to prevent these outcomes, including safeguards against disconnection during extreme weather, waiver of reconnection fees, and policies that prevent utility debt from damaging household credit. These protections are essential to keeping families housed, safe, and financially stable.

Support Households in Navigating a Changing Safety Net. Even before the threat of LIHEAP cuts, families often encountered confusing eligibility rules and difficult application processes. Now, with the program potentially facing funding cuts, households face not just the loss of assistance but a lack of clarity about what comes next. Sudden program disruptions create confusion, fear, and gaps in access. States, cities, counties, and community organizations must proactively communicate about what supports remain available, while also investing in modern, user-friendly systems. This includes building digital portals, training application navigators, and ensuring consistent implementation across agencies.

We cannot abandon the communities bearing the brunt of our changing climate’s growing financial toll. Whether through federal action, state-level leadership or private investment, the need for energy assistance has only grown and our response must grow with it. Want to follow this work as it unfolds? Sign up for our newsletter to get the latest updates and ways to engage.

A Note on the Survey Sample

The data in this blog comes from (1) a 2024 Energy Cost Burden Survey (n = 855) and (2) a survey fielded in April 2025 (n = 1,144) focused on energy cost burden, access to energy assistance, and uptake of clean energy technologies. State-level data presented in the analysis includes: California (n = 110), Texas (n = 91), Florida (n = 64), and Georgia (n = 51). LIHEAP recipients make up 22% of the survey sample (n=227). The sample reflects a diverse cross-section of SaverLife’s national member base, with strong representation from communities most vulnerable to energy and climate-related financial hardship.

Housing status among respondents was split between renters (57%) and homeowners (43%). In terms of racial and ethnic identity, 33% of respondents identified as Black or African American, 10% as Hispanic or Latino, 50% as white, and 5% as Asian. The sample skews predominantly female, with 80% of participants identifying as women. Regarding age, 65% of respondents were between 35 and 54 years old, while 12% were 55 or older. Financially, 48% of participants reported annual household incomes under $50,000.

About SaverLife’s Research on the Financial Impacts of Climate Change

SaverLife’s Downpour project is a research initiative that explores how the impacts of climate change are further straining household budgets with the goal of providing actionable data and research to policy makers, the financial health field, and advocates. SaverLife will continue capturing timely, household-level insights. As policies and programs evolve, our research on the financial impacts of climate change helps us and our partners stay grounded in how households are experiencing climate change and energy costs and what they need to build resilience. We’ll be releasing climate-related research and storytelling pieces throughout 2025 and sharing what we learn.